Suva, Fiji – 15 October 2025 – Pacific Island nations have completed a training program aimed at streamlining Customs operations and reducing trade barriers across the region, with Fiji’s success story pointing to potential economic benefits for smaller economies.

The Oceania Customs Organisation concluded Phase II of its trade facilitation workshop series this month, bringing together Customs officials from across the Pacific to learn from established programs in Australia and Japan.

The workshops focused on Authorized Economic Operator (AEO) programs – systems that fast-track Customs processing for businesses that meet strict compliance standards.

For Pacific Island economies, where trade costs are typically higher due to geographic isolation, such programs could provide significant competitive advantages.

Fiji has become the standout example in the region, with its AEO program expanding from just seven companies in 2018 to 23 certified businesses by 2025 – representing 228 percent growth over seven years.

Mohammed Sharif from the Fiji Revenue and Customs Service detailed the programme’s development: “The Gold Card programme launched in 2012 evolved into our current AEO framework by 2018. Starting with seven pilot companies, we now have 23 certified entities and 77 Gold Card members, demonstrating sustained growth in business participation.”

The Fiji model integrates tax and Customs compliance under a single framework, with membership terms extended from two to three years to encourage long-term business commitment.

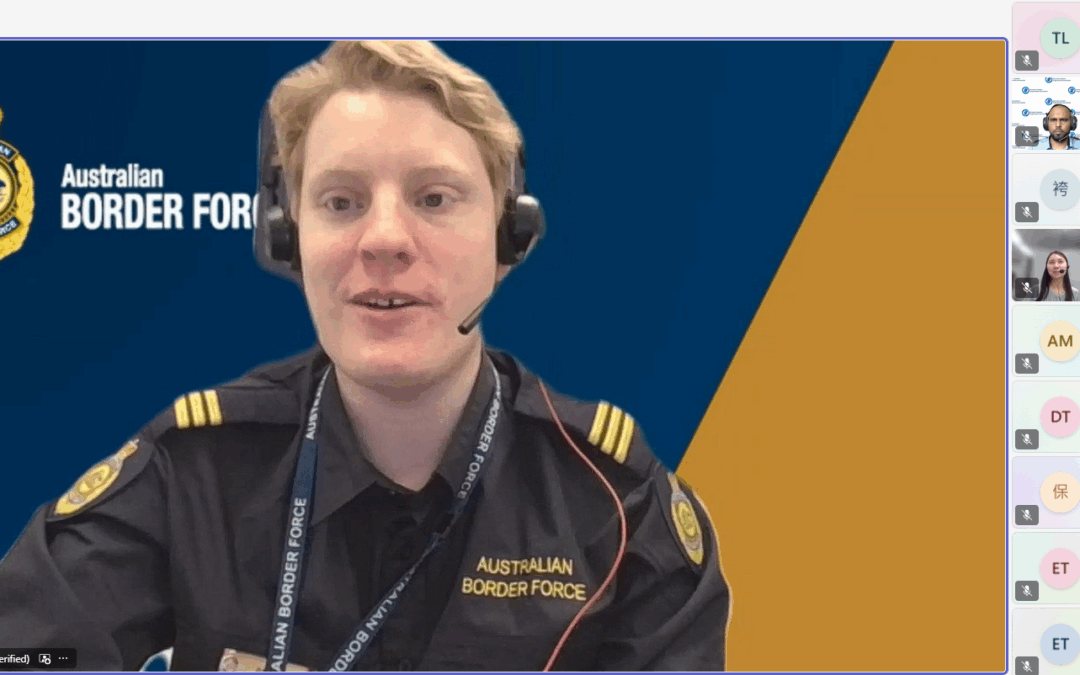

The workshop also featured presentations on Australia’s Trusted Trader program and Japan’s extensive AEO system, which now covers more than 750 companies handling over half of Japan’s export trade.

Australia’s Border Force shared operational insights from their program, which has focused on risk-based Customs management and public-private partnerships. Japan’s model demonstrated how strategic government targets can rapidly scale participation – achieving over 50 percent export value coverage by AEO members within a year of launch.

“Phase II has equipped Pacific Customs administrations with practical frameworks for implementing trusted trader programmes,” said Nancy Oraka, OCO Head of Secretariat. “The workshops demonstrated how countries can adapt international standards to their specific economic contexts while maintaining compliance with global requirements.”

The training program forms part of broader efforts to create mutual recognition agreements between Pacific nations, which would allow certified traders to receive expedited processing across multiple countries.

Two pathways have emerged: bilateral agreements between individual countries, which Fiji is currently pursuing, or a comprehensive regional framework covering all Pacific participants.

“These workshops addressed practical implementation challenges that Pacific nations face,” said Laisa Naivalurua, OCO Operations Manager. “Countries developed concrete understanding of how to balance trader benefits with enhanced security obligations, and established pathways for regional cooperation through mutual recognition agreements.”

For Pacific Island economies, AEO programs offer potential solutions to longstanding trade challenges. Benefits for certified businesses typically include:

- Reduced Customs inspections and faster processing times

- Deferred duty payments improving cash flow

- Priority handling during peak periods

- Simplified documentation requirements

However, upgrading IT systems and security infrastructure is expensive, especially for Small Island Administrations.

Phase III workshops will focus on putting the frameworks into practice and creating sustainable systems for countries to accept each other’s customs procedures and certifications.

The initiative aligns with World Trade Organization Trade Facilitation Agreement (Article 7.7) and the World Customs Organization SAFE Framework of Standards commitments on trade facilitation and supports Pacific regional integration goals.

ENDS